Protocols

(!) Please note that to access the documents cited in this section, you must login into your account, then the LIBRARY Menu on top will be displayed. If you want an account, please select a web subscription option

GUIDANCE FOR COMMERCIALLY VIABLE ENERGY EFFICIENCY FINANCING

When considering the value of energy efficiency as the most cost-effective way to reduce pollution and improve climate control, the opportunities are even greater. Unfortunately, there are several major barriers to the widespread implementation of clean and proven energy efficiency technologies that apply to virtually all stakeholders and countries around the world.

When considering the value of energy efficiency as the most cost-effective way to reduce pollution and improve climate control, the opportunities are even greater. Unfortunately, there are several major barriers to the widespread implementation of clean and proven energy efficiency technologies that apply to virtually all stakeholders and countries around the world.

One of the most significant of these barriers is a lack of commercially viable financing, which is not caused by a lack of available funds per se, but rather by an inability to access existing funding capacity at local banks and financing institutions (LFIs) on commercially attractive terms. This lack of access is caused by a “disconnect” between the traditional lending practices of LFIs and the financing needs of energy efficiency projects.

LFIs typically apply their traditional “asset-based” corporate lending approach for energy efficiency projects that is limited to their lending a maximum of 70%-80% of the value of assets financed (or collateral provided). Unfortunately there is often little or no collateral value in the energy efficiency equipment once installed in a facility; rather, the value is the cash flow generated from the equipment after installation. To date, most LFIs (due to lack of knowledge) have not recognized nor appear to believe that meaningful cash flow can be generated from energy efficiency projects, or that such cash flow can be relied upon to repay the related loans. Consequently, LFIs generally assign no value to the cash flow generated, thus requiring end-use energy consuming facility owners (“Hosts”) to encumber their credit capacity to finance energy efficiency.

Many end-use energy efficiency projects can reduce the existing operating costs of Hosts enough to pay for 100% of the required debt service. These “paid from savings” projects, called Energy efficiency and renewable Savings-based Projects (“ESPs”), create substantially new credit capacity for the Hosts, which is essential for LFIs to consider in their evaluation of financing ESPs. LFIs do not seem to recognize this increased credit capacity, which is caused, in large part, by the fact that they:

- do not appreciate the broader business opportunities and economic benefits of ESPs;

- are not familiar with the unique complexities of ESPs;

- do not have the internal capacity to properly evaluate risks and benefits of ESPs; and

- are unwilling to invest in building internal capacity to properly evaluate ESPs due to the relatively small dollar size of the investment.

Underlying the difficulties in financing energy efficiency is the low priority private sector Hosts place on investing capital or utilizing their credit capacity to finance energy efficiency versus their core business activities. The problem emanates from the relatively small investment and returns of energy efficiency projects coupled with a perception that they reflect energy and “utilities” infrastructure investments that only need to be made when if and when they break. Even energy efficiency projects with very high 25 to 50 percent IRR’s are unable to compete with one-year internal hurdle rate of returns “projected” for core business investments of many large industrial Hosts.

Unfortunately, there are relatively high risk factors associated with “projected” returns on core business investments that are not properly compared to the relatively low risk of investing in energy efficiency. For example, when a Host secures a loan to increase its production capacity, the loan repayment must be reflected in new budgeted product costs. The ability of a Host to repay a loan for an increased production investment like this one depends on the market’s acceptance of the product and its price – third party customers must be willing to purchase the products at the expected higher volumes and/or accept higher product prices in order for the Host’s expected repayment funds to materialize. The higher costs affect the Host’s competitive market position and result in a negative impact on its business that could affect the Host’s ability to repay the loan.

In contrast, when a loan is secured to fund a cost-effective energy efficiency project, the loan repayment stream comes out of the avoided utility costs already being incurred by the Host. No new budget costs need to be recouped since the project pays for itself out of operating savings. Control of the available funds is an internal matter that can be monitored with relatively low risk. Further, when a loan is secured to improve energy efficiency, the net effect is reduced operating costs, which lower product costs and make the Host more competitive. The Host, in this case, improves its creditworthiness.

LFIs have two basic business functions: one is to “rent” (lend) money and the other is to provide traditional banking and financial services to its customers. Funding ESPs for a Host also provides a secure means of renting money, while providing a valuable service to the Host and its suppliers, and supporting efforts to improve our environment.

The major risks in providing an energy efficiency loan are:

- initially, the quality of the engineer’s auditing abilities and calculations; then

- implementation according to design; and finally

- sustained savings and agreed measurement thereof

Acquiring or training personnel to evaluate an engineer’s audit is relatively simple. If an Energy Services Company (ESCO) is involved in the ESP, the LFI’s risks are significantly reduced because of the ESCO’s assumption of the performance risks. An ESCO is a performance-based company that: i) develops, finances and implements ESPs on a “turn-key” basis, and ii) risks payments for its services on actual savings performance of equipment installed. The ESCO typically guarantees that energy savings from its ESPs will cover their capital and financing cost, which includes the loan repayment to LFIs. As discussed above, loans to a Host for core business activities like a production enhancement carry a far greater risk than energy efficiency due to the marketing risks and possible engineering risks.

Once LFI personnel understand the comparative business propositions and can effectively evaluate the benefits and risks of the energy efficiency measures proposed, they will find that financing energy efficiency carries a much lower risk than financing business expansions and other capital investments.

If LFIs are to fulfill their role in serving the world’s energy, economic and environmental needs through greater energy efficiency, they must understand the potential market and have the ability to effectively serve it. Once LFIs understand the multiple benefits of financing energy efficiency, they can not only improve their respective businesses, but also take the lead in explaining the project economics to their customers who ultimately are the Hosts for ESPs.

THE NEED FOR GUIDANCE AND EXPERTISE ON ENERGY EFFICIENCY FINANCING

In July 2004, the UN Foundation’s Energy Future Coalition sponsored a stakeholder workshop in which a broad group of experts in energy efficiency and finance met to discuss barriers to increased use of funds for energy efficiency projects. The experts agreed that local financial institutions (LFIs) lacked the guidance and expertise to feel comfortable lending money on a cash flow basis to energy efficiency projects. A consensus was reached that an International Energy Efficiency Financing Protocol (IEEFP), as proposed by Mr. Thomas K. Dreessen, could help to bridge the gap between funding sources and their financing of energy efficiency projects. The meeting further concluded there is already a number of documents, materials and other tools that could be assembled in an IEEFP Repository with relative ease.

Later that year, the Efficiency Valuation Organization (EVO) agreed to sponsor the IEEFP and began efforts to obtain funding. It formed a global working group (GWG) comprised of interested stakeholders with expertise in various aspects of energy efficiency financing to oversee development of the IEEFP. As the world’s only organization solely dedicated to a mission of providing tools to quantify energy efficiency business transactions, EVO developed and published the International Energy Efficiency Financing Protocol (IEEFP) in 2009.

IEEFP was created as a global “blue print” for educating and training LFIs around the world on the special intricacies, benefits and risks of financing end-use energy efficiency projects. The objectives of IEEFP are to create a better understanding amongst LFIs of:

- how energy efficiency projects generate reliable savings in operating costs of end-use energy consuming facility owners (Hosts), and

- how such savings equate to new cash flow and increased credit capacity for Hosts to repay energy efficiency project loans and investments.

In 2017, EVO has engaged the process of updating and modernizing the IEEFP to reflect the growing needs of the financial community. In 2019, EVO submitted a proposal to the Government of Canada to contribute to the update of the IEEFP. An international contribution agreement was signed, and EVO concluded a series of workshops with the assistance of an International Working Group and a Canadian Working Group. Members of these working groups provided technical review and input, reflected in the 2021 updated IEEFP and complementary Canadian Annex.

It is envisioned that additional country annexes will be produced, reflecting varying barriers to implementing and financing energy efficiency projects and local banking regulations.

(Please note that to access the documents cited in this section, you must login into your account, then the LIBRARY Menu on top will be displayed. If you want an account, please select a web subscription option)

From the outset of the first publication of the International Performance Measurement and Verification Protocol (IPMVP®), the objective of its originators was to develop a consensus approach to measuring and verifying efficiency investments to facilitate a scaled-up global engagement into energy efficiency.

From the outset of the first publication of the International Performance Measurement and Verification Protocol (IPMVP®), the objective of its originators was to develop a consensus approach to measuring and verifying efficiency investments to facilitate a scaled-up global engagement into energy efficiency.

The purpose of the IPMVP is to reduce barriers to the energy and water efficiency industries. Adopted broadly by energy services companies initially, the IPMVP is now used by utilities and government agencies for their demand-side management incentive programs and by building, manufacturing, and industrial managers to assess and improve their facilities’ performances. Increasingly, financial institutions understand the advantages of using the IPMVP as a risk reduction framework for their investments.

In the context of the global energy transition to a low carbon economy, the IPMVP also offers a consistent approach to measuring and verifying carbon emissions reduction in a broad range of energy sectors, including different types of facilities, industrial applications as well as renewable energy.

As primarily a non-prescriptive framework, the IPMVP provides an overview of M&V's current best practices while remaining flexible. It is also a living document whose methodologies and procedures enable the protocol to evolve and reflect current and new market needs.

The IPMVP is owned and maintained by Efficiency Valuation Organization (EVO®) is a non-profit organization whose products and services help people engineer and invest in energy efficiency projects. EVO's vision is to create a world that has confidence in energy efficiency as a reliable and sustainable energy resource. EVO's mission is to ensure that the savings and impact of energy efficiency and sustainability projects are accurately measured and verified.

EVO is the only organization globally with the exclusive focus on measurement and verification (M&V). EVO’s activities span over three important fields: M&V protocol development, M&V training and education programs, and certification of industry professionals. To accomplish its mission, and vision, EVO relies on the vast knowledge and expertise of an international team of over one hundred M&V practitioners and instructors.

SCOPE

The guidance provided throughout this document is focused on “energy savings” and can also be applied to demand, water consumption, related cost savings, emission reductions, or any other quantities being measured and verified. M&V is fundamental to energy efficiency financing, energy performance contracting, energy performance management, GHG accounting efforts, and many government and utility programs.

IPMVP provides a framework that is used to:

1) verify a project has the potential to perform and save energy, and

2) quantify site-level energy and cost impacts from a targeted project.

Both components are essential to the measurement and verification (M&V) of savings.

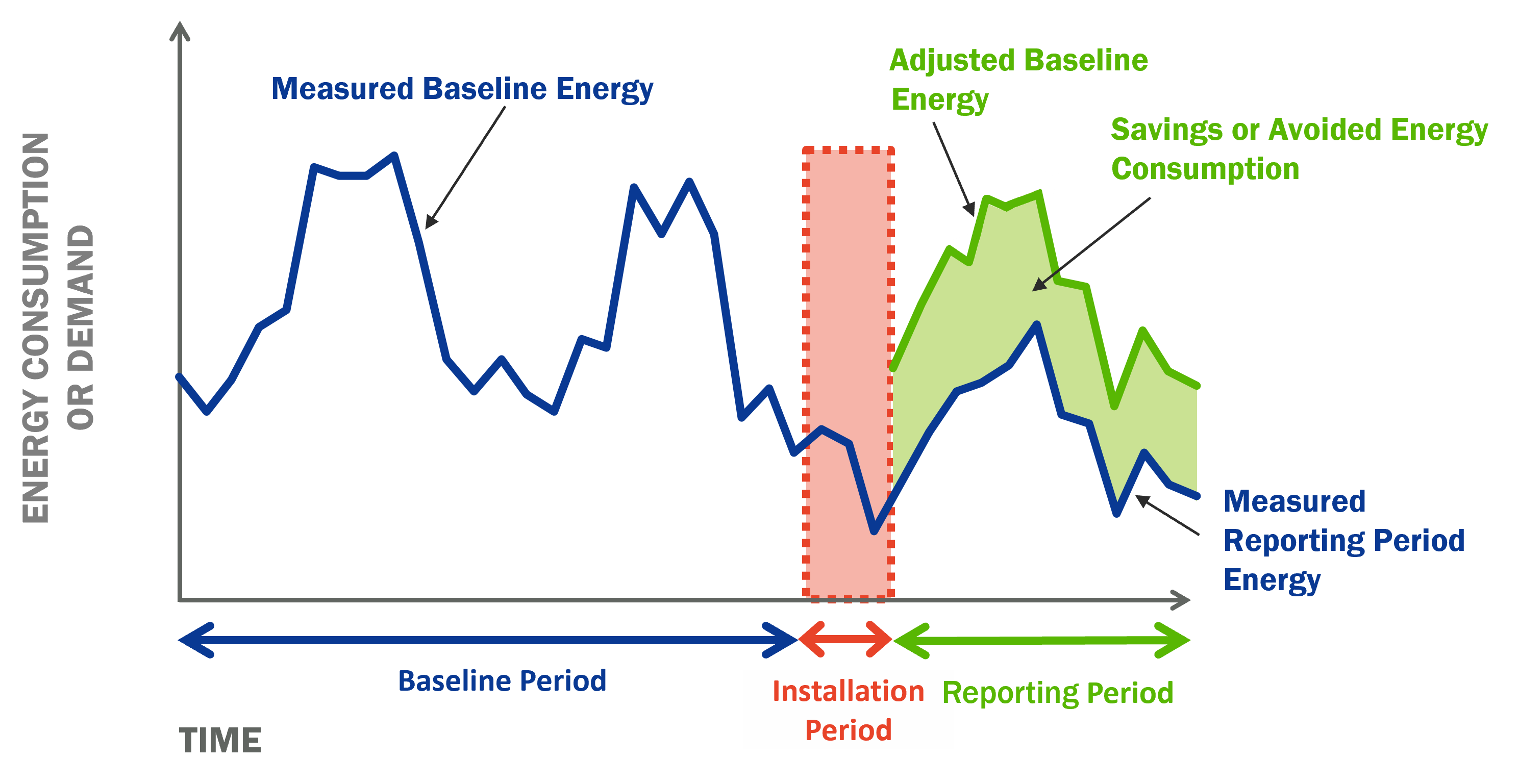

Energy savings in a facility cannot be directly measured because savings represent the absence of consumption or demand. Instead, savings are based on measurements of each fuel type or energy source impacted within a given measurement boundary before and after implementing a project, making suitable adjustments for changes in conditions.

IPMVP presents common principles and terms widely accepted as fundamental to any good M&V process. It does not define the M&V activities for all applications. Each project must be individually designed to suit the needs of all stakeholders in the reporting of energy or water savings. This individual design is recorded in the project’s M&V Plan, and savings are reported as defined therein. Using the IPMVP’s principles, framework, terms, and process to determine and report verified energy savings, facilitates reliable and translatable results.

FRAMEWORK

Energy, demand, water, greenhouse gas emissions, or other savings in a facility cannot be directly measured because savings represent the absence of energy/water consumption or demand. Instead, savings are determined by comparing measured energy consumption or demand before and after implementation of an energy efficiency measure (EEM), making suitable adjustments for changes in conditions. The comparison of before and after energy consumption or demand must be made on a consistent basis

MEASUREMENT BOUNDARY

Savings may be determined for an entire facility or a portion of a facility, depending upon the characteristics of the EEM(s) and the purpose of the reporting.

The measurement boundary is used to isolate the equipment and related energy use which are impacted by the EEM(s) from those unaffected by the EEM(s). All energy used or generated within the boundary must be measured or estimated using meters at the measurement boundary. Note that energy flows from all energy sources crossing the measurement boundary should be evaluated, and those impacted by the EEM must be measured. Note that in some cases, such as on-site solar generation, energy may flow in reverse.

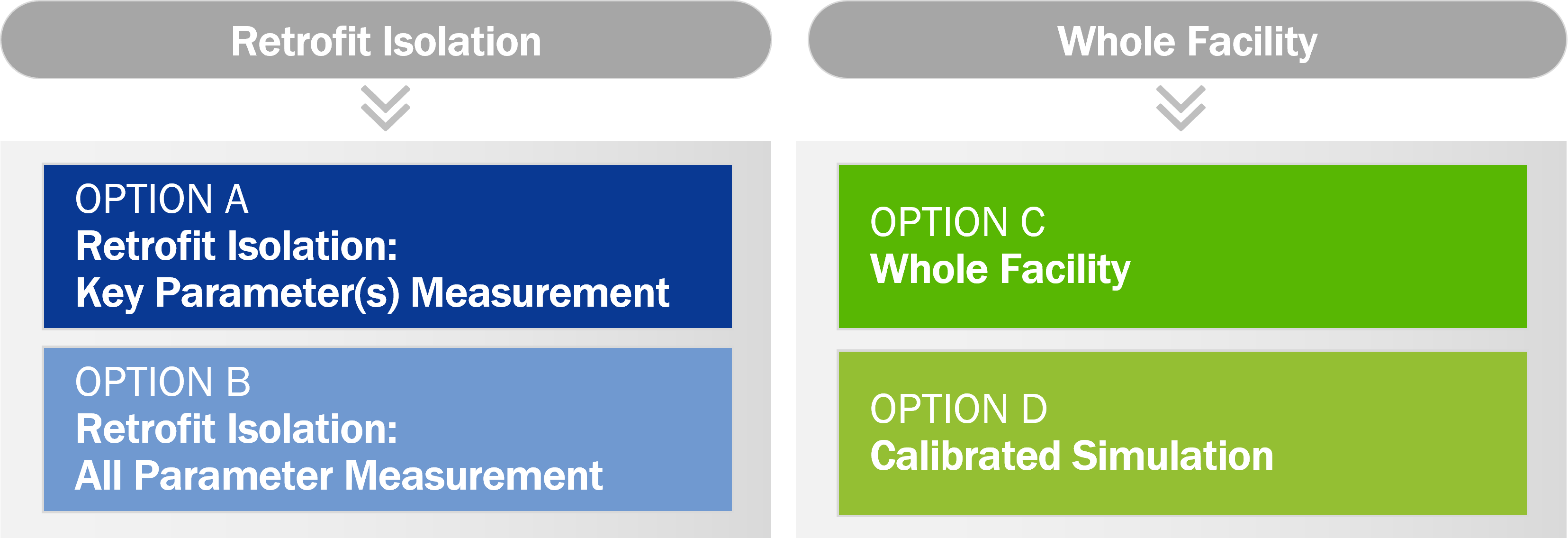

The type of measurement boundary selected generally aligns with one or more of the four IPMVP Options, shown below, and impacts the granularity of the savings reported and the measurements required. The purpose(s) of the M&V reporting must be considered when selecting an Option.

If the purpose of reporting is to verify the savings from equipment affected by the energy efficiency project, a measurement boundary should be drawn around that equipment, and measurement requirements for the equipment within the boundary can then be determined. Energy consumption and/or demand may be directly measured or determined by direct measurement of key variables that can be reliably used to calculate demand or energy consumption. The approach used is a Retrofit Isolation Option (Option A or B)

If the purpose of reporting is to verify and/or help manage total facility energy performance or verify the savings from multiple EEMs with interactive effects, the meters measuring the supply of energy to the whole facility can be used to assess performance and savings. The measurement boundary, in this case, encompasses the whole facility. The approach used is Option C: Whole Facility.

If the Baseline Period or Reporting Period data are unreliable or unavailable (e.g., new construction), energy data from a calibrated simulation model can be applied for either a portion or all of the facility. The measurement boundary can be drawn accordingly. The approach used is Option D: Calibrated Simulation.